Office of Research

At UAA, we understand the importance of being on the cutting edge of theoretical and applied research in health, engineering, and the physical and social sciences. We value the impact of our undergraduate and graduate researchers, and we create many opportunities for students to work closely with highly qualified faculty in state-of-the-art labs that are built to address some of the Arctic’s most pressing problems. We do this because we firmly believe that the path forward for Alaska and the world will be driven by our students — by your curiosity, passion, and belief in a brighter tomorrow.

Research Themes

Engineering Solutions for Alaska and Beyond

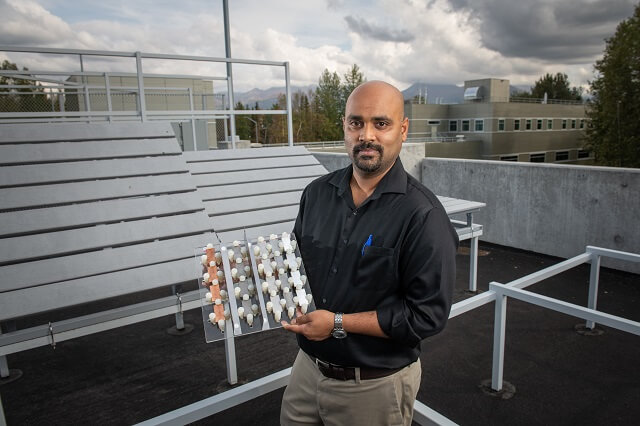

In many ways, Alaska is a unique place that requires a unique approach to engineering. The wilderness is vast, the population centers are dispersed, and the effects of climate change are felt by many. Thankfully, the faculty and students at the UAA College of Engineering are up to the challenge. To help humans weather Arctic and subarctic conditions, the civil engineers are designing new mixtures of asphalt and testing new materials for home construction, the mechanical engineers are studying cold temperature corrosion, and the geomatics engineers are developing improved techniques for mapping the effects of permafrost melt and earthquakes. In every discipline within the college, there is an opportunity to engage in research that can benefit Alaska and other Arctic communities.

On the Frontlines of Health Research

As the health campus for the University of Alaska system, the UAA College of Health plays a key role in Alaska’s medical community — and the College’s research activities inform decision makers not only at the local level, but also nationally and internationally. For example, the Institute for Circumpolar Health conducts research that offers insights into the challenges and opportunities for rural health organizations. Their results and recommendations are often applicable both in Alaska and in large swathes of the circumpolar region. And this is only one arm of the College of Health’s research activities. In pharmacy, in justice, in social services, and in medicine, there are opportunities to make an impact through research.

Understanding Nature and Human Nature

Across UAA’s many disciplines, there are faculty and students who study the natural world, the social world, and the world of the mind. UAA’s biologists seek microbes in inhospitable environments like volcanoes and glaciers, and then develop techniques to use those microbes to safely mine rare earth metals. UAA’s economists investigate the ways that climate change is transforming not only our environment, but how we operate as individuals and organizations. UAA’s psychologists examine the stimuli that affect lab rats and make connections to the human experience. And these are just a few examples of the many ways that UAA’s natural and social scientists are adding to our body of knowledge.

Student Research Opportunities

Undergraduate Research: Get Ahead of the Curve

UAA is an institution that primarily serves undergraduate students, yet we also carry out a great deal of theoretical and applied research — and this is a huge advantage for our undergrads who want to experience the life of a researcher. In nearly every discipline, there are ample opportunities to join research teams and collaborate with experienced faculty mentors. Many students work as paid research assistants on specific projects, while other students complete meaningful research activities with real-world effects as part of their coursework. Some students even win grants to pursue their own research interests. In short, UAA is an institution where both undergraduate education and research are core to our mission and culture.

Graduate Research: Digging Deeper

There is a growing number of master’s and PhD programs available at UAA, and we fully believe that research is an integral part of the graduate school experience. Our graduate students need the opportunity to dig deeper — to learn and practice the latest methods, to strive for innovations that are meaningful and relevant right here in Alaska. Whether in health, engineering, or the physical and social sciences, our graduate students are given the tools and the guidance they need to step into the lab or the field with confidence.